By pittsburgh-merchantservices October 1, 2025

Membership-based merchant services are changing how small and midsize businesses in Pittsburgh accept payments—from bustling Strip District cafés and sports-bar hotspots on the South Side to boutiques in Shadyside, professional practices in Oakland, and tradespeople serving neighborhoods across Allegheny County.

Instead of paying a confusing blend of percentage markups, per-transaction add-ons, and “statement” fees, merchants pay a predictable monthly membership to access wholesale (interchange) processing costs and enterprise-grade tools.

Think of it like moving from pay-per-ride to a monthly transit pass: your core costs become transparent and steady, and you stop being nickeled-and-dimed for every small feature.

This guide breaks down, in plain English, how the model works, why it’s a compelling fit for many Pittsburgh operators, what to look for in providers, and how to roll out a smarter payment stack with minimal disruption.

We’ll go deep on pricing math, hardware and software selection, PCI and data security, cash-flow and reconciliation, and step-by-step migration tactics that reduce risk during peak hours.

We’ll also cover industry nuances—restaurants vs. retail vs. services—and the metrics that will prove whether your membership plan actually delivers the ROI you were promised.

Two quick notes before we dive in. First, “membership” is a pricing framework, not a single product. Providers differ in what’s included, what’s optional, and how they support you; you should evaluate the whole bundle, not just the monthly fee.

Second, there is no one-size-fits-all setup. Your card mix (debit vs. credit), average ticket, volume seasonality (game days! graduation season!), and POS needs will shape whether membership pricing yields real savings and smoother operations. With that in mind, let’s unpack the model and apply it to the realities of running a business in Pittsburgh.

What Are Membership-Based Merchant Services?

At its core, membership-based merchant services replace percentage-based processor markups with a flat monthly fee for access to wholesale interchange rates (the base costs set by the card networks and issuing banks) plus a small, fixed per-transaction authorization cost.

Instead of paying, say, 2.75% + 10¢ on every card present transaction, you might pay the actual interchange (which varies by card type and entry method) with 0% processor markup, a fixed 5–10¢ auth fee, and a predictable monthly membership that covers support, gateway access, reporting, and often extras like invoicing or recurring billing.

This model addresses the pain merchants feel with traditional pricing. With tiered rates, you may be quoted “qualified” and “non-qualified” categories that are opaque and often shift your transactions into higher-cost buckets.

With flat-rate aggregators, what you gain in simplicity you often lose in overpaying on debit or card-present swipes. Membership models keep the underlying interchange intact (because you still pay the networks and banks their wholesale cost), but remove or flatten the processor’s margin and tuck value-added tools into the membership fee.

From an operational standpoint, membership bundles typically include:

(1) account setup and PCI assistance,

(2) access to a gateway and/or native POS integrations,

(3) hardware procurement or compatibility options (e.g., countertop terminals; iPad POS; Android smart terminals; mobile readers),

(4) recurring billing and card-on-file vaulting,

(5) ACH and RTP/instant payout options where supported,

(6) chargeback monitoring and representment workflows,

(7) robust reporting with export to accounting platforms, and

(8) responsive support that understands both the tech stack and the realities of a busy Friday night.

For Pittsburgh businesses, the membership approach is especially helpful because of the city’s mixed economy. A small café with a $12 average ticket and heavy debit mix shouldn’t pay the same effective margin as a boutique service firm with $600 invoices.

Membership pricing lets the café capitalize on low-cost regulated debit interchange while the service firm benefits from predictable, budgetable fees and cheaper card-not-present tools than many “simple” flat-rate options.

Across both, transparency is the upside: when your costs map to real, published interchange tables plus a fixed membership, you’re less likely to be surprised by rate creep or statement clutter.

Still, membership isn’t magic. You’ll want to scrutinize the membership fee against your monthly volume, verify the per-transaction auth cost, and check whether specific features (e.g., text-to-pay, surcharging where permitted and compliant, Level II/III data for B2B cards) are truly included or billed a la carte.

Look for month-to-month terms, no PCI “non-compliance” junk fees (if you complete your SAQ), and clear cancellation language. The goal is to achieve both lower lifetime cost and better predictability—not to trade one kind of uncertainty for another.

Why Pittsburgh Businesses Are Switching to Membership Pricing

Pittsburgh has an unusually diverse transaction landscape. On any given weekend, you’ve got stadium crowds streaming through North Shore venues, university traffic in Oakland, neighborhood loyalty in Lawrenceville and Squirrel Hill, and destination diners in the Strip.

That mix produces highly variable ticket sizes and card mixes, and it punishes one-rate-fits-all pricing. Membership models let an operator benefit from their reality rather than subsidize someone else’s.

Consider debit. In many Pittsburgh neighborhoods, locals prefer debit for day-to-day spending. Regulated debit interchange (for large-bank issuers) is significantly lower than a typical flat-rate plan.

Under a membership model, you capture those savings: you pay the true debit interchange plus a small auth fee instead of a high blended rate. Over thousands of swipes per month, that delta adds up to real money—funds that can go toward adding a patio heater for winter, hiring an extra barback for Steelers home games, or investing in improved online ordering.

Seasonality is another factor. Pittsburgh sees back-to-school surges, holiday shopping spikes, and event-driven crowd swings. Percentage markups scale your processor’s take precisely when your business is the busiest.

A fixed membership fee flips that equation: the busier you are, the less your effective overhead (membership divided by more volume). For growth-oriented merchants—new second locations in Bloomfield or weekend pop-ups at farmers markets—that’s a structural advantage.

There’s also the practical matter of support. Operators in Pittsburgh often juggle complex setups: a countertop POS plus handhelds for sidewalk seating in summer, integrated online ordering for pickup during winter storms, and occasional mobile readers for events.

Membership providers that center their economics on long-term retention (not squeezing every basis point) tend to staff more knowledgeable support and provide cleaner integrations: multiple registers on one plan, centralized reporting, and reconciliation that won’t make your bookkeeper want to move to Erie. That operational sanity is a competitive advantage, especially for lean teams.

Finally, membership pricing can improve vendor alignment. If your provider’s revenue doesn’t balloon every time your interchange shifts, they’re less incentivized to keep you on outdated hardware or an aggregator that obscures costs.

Instead, they’re motivated to help you route transactions efficiently (chip/tap over key-entered), capture Level II/III data for corporate cards, and implement card-on-file with proper tokenization so you don’t eat unnecessary “keyed” interchange.

In other words, your success is more tightly coupled to theirs, and that often leads to better outcomes in deployment, training, and ongoing optimization.

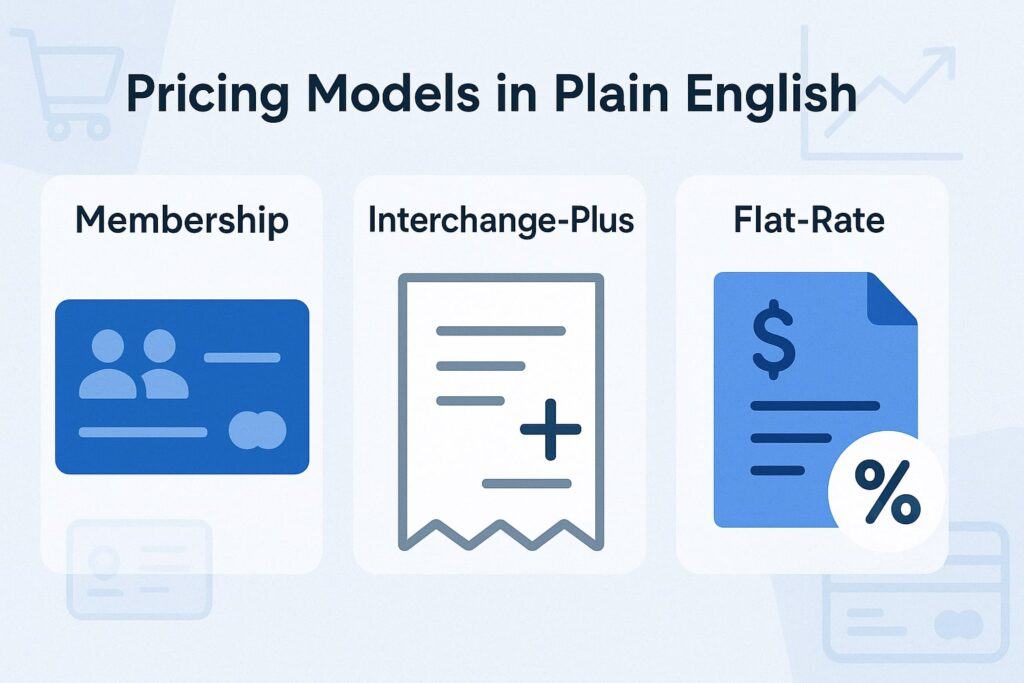

Pricing Models in Plain English: Membership vs. Interchange-Plus vs. Flat-Rate

Merchants usually encounter three paradigms: (1) flat-rate (e.g., 2.6% + 10¢), (2) interchange-plus (e.g., interchange + 0.25% + 10¢), and (3) membership (interchange + fixed auth cost + monthly fee, with 0% markup). Each has a place, but they behave differently across card mixes and ticket sizes common around Pittsburgh.

Flat-rate is easy to predict but often expensive on debit and card-present EMV/tap transactions. It shines for very low volume micro-merchants who value simplicity above all else, but once you cross a modest threshold—say, $15,000–$25,000/month—flat-rate’s convenience premium tends to outweigh its benefits.

Interchange-plus is more transparent, but the percent markup ensures your costs rise in lockstep with volume, and you can still run into nuisance fees (PCI, AVS, batch, and “regulatory” pass-throughs).

Membership eliminates the percentage margin entirely. You still pay wholesale interchange (unchangeable), but the processor cut becomes fixed and decoupled from volume, which is powerful if you’re growing or have a favorable card mix.

When evaluating offers, run a simple three-step test:

(1) estimate your monthly card-present vs. card-not-present split,

(2) estimate debit vs. credit mix and average ticket, and

(3) model each plan across high/low months to see the effective blended rate.

Don’t forget to include all fees: gateway, PCI, “regulatory product,” batch fees, chargeback fees, and any software licenses. With membership, pay special attention to the auth fee: a $0.08 versus $0.15 auth can materially change costs for low-ticket, high-volume operators (coffee shops, quick-serve).

For higher-ticket operators (home services, clinics), the per-auth difference matters less than removing percentage markup on large invoices.

Worked Example: Downtown Café with Heavy Debit Mix

Imagine a downtown café near Market Square with $65,000 in monthly card volume, 80% card-present, 20% online. The average ticket is $11. Card mix is 60% debit, 40% credit; most credit is standard rewards, not premium. We’ll compare three models.

Flat-Rate (2.6% + 10¢)

At $65,000 volume, the percentage fee alone is $1,690. The per-transaction piece adds up quickly: at an $11 ticket, you’re looking at roughly 5,909 transactions (65,000 ÷ 11), which adds about $590.90 in per-txn fees.

Total before any extras: ~$2,280.90. Add a $15 “PCI program” and $10 gateway and an occasional $25 chargeback, and you’re near $2,330–$2,360/month in processor charges.

Interchange-Plus (interchange + 0.25% + 10¢)

Your interchange varies—regulated debit might be ~0.05% + 22¢; basic credit might be ~1.51% + 10¢; premium rewards more. On a 60/40 debit/credit mix with many small tap transactions, your raw interchange could land near a 1.0–1.2% blended equivalent (owing to the fixed cents on debit).

Layer the 0.25% + 10¢ markup on roughly 5,909 transactions and $65,000 volume, and you’re adding ~$162.50 in percent markup plus ~$591 in per-txn markup = ~$753.50 on top of interchange.

Toss in a $10 gateway and a $10–$20 PCI line, and you’ll likely live around $1,800–$2,000 total monthly processing cost depending on the actual interchange profile.

Membership (wholesale interchange + $0.08 auth + $79 membership)

Now you pay the same raw interchange as above (no escaping that), plus 5,909 × $0.08 = ~$472.72 in auth costs, plus $79 membership, plus (often) a $0 gateway line if included. Total processor margin: ~$551.72.

Your all-in cost = actual interchange + ~$552. If your blended interchange for this mix lands near $900–$1,000, your total hits ~$1,450–$1,550—hundreds less than the other options. The savings grow as volume grows or as your debit share rises.

What about risk factors? If your average ticket drops to $7, the per-auth fees become more impactful; you’d push 9,285 transactions, adding ~$742.80 in auth cost. Even then, as long as debit remains significant, the membership plan often wins because you’re not paying a percent markup on every dollar of coffee and muffins sold.

Conversely, if your mix flips to premium credit cards (say, a destination dessert bar), interchange rises regardless of pricing model; membership still prevents a second margin layer from ballooning.

The point is not that membership always wins—it’s that it aligns processor economics with your operating reality. Do the math on your ticket size, card mix, and splits, and insist on a side-by-side quote using three months of real statements. In many Pittsburgh scenarios, you’ll find membership pricing is the cleaner, cheaper way to scale.

The Feature Checklist: What a Pittsburgh Merchant Should Expect

Beyond pricing, your membership should feel like a toolkit that supports how your customers actually pay—chip/tap at the counter, text-to-pay for deposits, online ordering for pickup during snow days, and invoices for B2B services. Here’s how to think about the bundle:

- Point of Sale (POS) and Terminals: Look for compatibility with modern EMV/contactless devices (tap to pay is now table stakes), handhelds for patio or line-busting, and kitchen printers or kitchen display systems (KDS) if you’re a restaurant.

Ask about offline mode for the occasional connectivity blip and about tips/adjustments for bars and full-service restaurants. If you’re retail, check barcode scanning, SKU management, and exchange workflows.

Hardware shouldn’t lock you into one vendor forever; membership models that are device-agnostic reduce switching risk. - Online and Omnichannel: A first-class gateway, hosted pay pages, and easy integrations with e-commerce platforms (Shopify, WooCommerce, BigCommerce) matter even for brick-and-mortar shops when winter weather shifts demand online.

For services, ensure embedded pay links, QR-based checkout, and text-to-pay are available. Card-on-file tokenization should be standard—and compliant—so you can offer subscriptions, membership programs of your own, or stored cards for regulars. - Invoicing and Recurring Billing: Contractors in Mt. Washington or professional practices in Oakland need flexible invoicing with partial payments, deposits, and automated reminders.

Recurring plans (weekly, monthly, annual) with proration and dunning (failed-payment retries) reduce admin time. ACH support can cut costs on larger invoices; ideally, ACH lives in the same reporting as cards, not in a silo. - Reporting and Reconciliation: Daily batches, deposit timing, fee transparency, and accounting exports (QuickBooks, Xero) keep your books clean.

You’ll want batch summaries that actually tie to the bank deposit and statement-level fee breakdowns you can read without a decoder ring. Payment IDs that follow the transaction across POS, gateway, and dispute systems save hours in back-office time. - Fraud & Disputes: For card-not-present, tools like AVS, CVV, velocity controls, and 3-D Secure should be available.

For card-present, EMV liability shift protection is a must. Chargeback alerts, easy evidence upload, and clear timelines help busy operators respond without derailing service. - Support: Pittsburgh businesses need human help that understands lunch rush and event surges. Ask whether support is 24/7, whether front-line agents can actually troubleshoot POS integrations, and whether on-site or same-day replacement options exist for terminals.

Membership providers that bank on long-term relationships often shine here—because they’re not trying to win on rate alone. - Contract Terms and Add-Ons: Prefer month-to-month over long auto-renewals, and avoid liquidated-damages early termination clauses.

Verify what’s included in the monthly membership (gateway, PCI program, basic invoicing) and which add-ons carry reasonable fees (advanced analytics, loyalty modules). Keep a copy of the complete fee schedule—no surprises later.

When the toolkit checks these boxes, the membership model becomes more than just pricing—it’s an operational advantage. You’ll process smarter, reconcile faster, and deliver a more modern customer experience without wondering which line item you just triggered.

A Practical Migration Plan for Busy Pittsburgh Operators

Switching payment providers can feel risky—no one wants downtime on a Penguins game night or during the Saturday brunch surge. A methodical migration plan reduces friction and protects cash flow. Here’s a blueprint used by operators who can’t afford missteps.

- Week 1: Discovery and Data: Gather the last three months of statements and POS reports. Map payment flows (countertop, handhelds, online, invoices) and list all integrations (inventory, online ordering, accounting, loyalty).

Identify pain points (slow batch funding, chargeback spikes, partial authorization issues). Ask the prospective membership provider for a line-by-line cost comparison and a proposed hardware/software architecture drawing—literally, a diagram that shows devices, network, and data flow. - Week 2: Configuration and Sandbox: Order hardware with time to spare. Configure the gateway, create test SKUs, set tax rates (be mindful of local rules), and connect your accounting system in a sandbox.

Validate receipts (logo, legal text, tip lines), check tip workflows (adjust vs. on-screen), and confirm who can void/return. If you take deposits, test split tender. For online, test variants: curbside, delivery zones (if applicable), and promo codes. - Week 3: Parallel Run: Run your old and new systems side-by-side during slower windows. Process test transactions with real cards (employee cards work), refund them, and confirm funding timelines in your bank account.

Train staff on the new checkout flow, tipping prompts, and what to do if a chip fails (fall back to contactless, then to keyed with AVS only when absolutely necessary). Prepare laminated “break glass” steps for line-busting devices. - Go-Live: Off-Peak Cutover: Choose a Tuesday morning—not a home game evening—to flip the switch. Keep the old terminal powered for one day in case you need to issue a void/refund on a pre-cutover transaction.

Monitor batches and deposits for the first 72 hours. Have your provider on a named “go-live bridge” line for immediate escalation. - Post-Launch: Optimize: After two weeks, review your first membership statement. Verify auth counts, look for any unexpected fees, and reconcile deposits with your POS/gateway exports.

Tune fraud rules for online payments (e.g., block mismatched ZIPs if that’s a problem for you) and adjust receipt text or tip prompts based on customer behavior. If you operate multiple locations—say, one in the city and one in the suburbs—confirm centralized reporting is grouping correctly and that staff permissions are scoped to the right store.

This plan works because it respects the reality of service businesses: train in small bites, test with real cards, and make changes off-peak. With a membership provider that’s invested in your long-term success, you should feel guided through each phase—not left to guess.

Compliance, Security, and Policy Considerations (Without the Jargon)

Payment acronyms can feel like alphabet soup, but a few concepts matter day to day:

- PCI DSS (Payment Card Industry Data Security Standard): Every merchant, whether you’re a micro-roaster in the Strip or a clinic in Oakland, needs to validate PCI annually—usually via a short Self-Assessment Questionnaire (SAQ).

A good membership plan includes PCI help at no extra cost and provides a hosted solution that keeps card data out of your environment (tokenization), reducing scope and stress. Avoid providers that use PCI as a revenue line item (“non-compliance fees”) rather than a support commitment. - EMV and Contactless: Tap-to-pay and chip transactions reduce counterfeit fraud and speed lines. Make sure your devices are certified for EMV contact and contactless. If a card’s chip fails, try contactless before falling back to a keyed entry with AVS—keyed transactions often carry higher interchange and more risk.

- Data and Privacy: If you use card-on-file, ensure the provider offers vaulted tokens, not raw card storage in your POS. Hash sensitive IDs, restrict staff access by role, and enable two-factor authentication on dashboards. For text-to-pay or email invoicing, only send links generated by your gateway, not ad-hoc “pay me” links.

- Surcharging and Cash Discounts: Rules differ by jurisdiction and card brand. If you consider passing fees, work with your provider to ensure your signage, receipt disclosures, and technical implementation meet current requirements and card-brand rules.

Many Pittsburgh merchants instead encourage lower-cost tender (debit, ACH) by offering convenience features rather than overt fees—e.g., providing ACH for large invoices. - Chargebacks: Document your service policies, keep signed receipts (or digital equivalents), and use clear descriptor text so customers recognize the charge.

For card-not-present, use AVS and CVV, ship to verified addresses, and keep proof of delivery. Membership providers that bundle chargeback tools and guidance make this less painful. - Accessibility and Inclusivity: Choose PIN pads and checkout flows that support accessible input and language options. Clear, large-font prompts improve tip capture and reduce checkout friction for all customers.

Compliance is not about scaring you; it’s about getting routine tasks right so you can focus on guests and growth. A strong membership provider turns this from a burden into a checklist you breeze through each year.

Proving the ROI: Metrics Pittsburgh Owners Should Track

Membership pricing should earn its keep. Treat the first 60–90 days as an experiment with a scoreboard. Define your “before” baseline using your last three months of statements and POS reports, then track these metrics:

- Effective Rate: Total fees divided by total processed volume, expressed as a percentage. Track it weekly and monthly. Under membership pricing, your effective rate should decline as volume rises or as your debit share increases.

- Cost Per Transaction: Helpful for low-ticket businesses. Add total fees divided by number of transactions; watch how it responds to changes in average ticket and auth fee.

If you add line-busting handhelds that increase transaction count (smaller tickets, more sales), make sure per-auth economics still pencil out. - Funding Speed and Consistency: Measure days to deposit and variability. If membership includes faster funding tiers or same-day options (often with small add-on fees), calculate the working-capital benefit compared to your old setup.

- Tip Capture (Restaurants/Bars): Compare average tip % pre- and post-migration. Cleaner prompts, mobile tableside, and tap-to-pay can lift tips—real value for staff retention.

- Chargeback Rate and Win Rate: With better tools and data, you should see fewer disputes and stronger representation outcomes. Document the trend.

- Staff Time on Reconciliation: Ask your bookkeeper to estimate weekly hours before and after. If centralized reporting and better exports save four hours per week, that’s meaningful.

- Uptime and Support Response: Track incidents and time-to-resolution. A good provider should show fewer outages and faster answers, especially during Pittsburgh’s peak traffic windows.

Review these metrics in a monthly “payment health check.” If the numbers don’t move, revisit your configuration: are too many transactions falling back to keyed entries? Are premium card downgrades avoidable with Level II data? Would adding ACH to invoices shift expensive card volume to cheaper rails? Membership pricing is a foundation; optimization turns it into an advantage.

Frequently Asked Questions

Q: Will a membership plan always beat flat-rate pricing for my shop?

Answer: Not always. Membership shines when you have either meaningful volume, a strong debit mix, or growing multi-location needs that benefit from predictable overhead. If you process only a few thousand dollars each month, a flat-rate aggregator may be cheaper in absolute dollars even if the effective rate looks worse.

The math changes as you grow: once your monthly volume climbs, the fixed membership overhead gets diluted and the savings stack up—especially on debit-heavy, card-present sales common across many Pittsburgh neighborhoods.

Also consider operational value. If the membership bundle includes a gateway, invoicing, and reporting you’d otherwise pay for separately, the total cost of ownership often favors membership.

Conversely, if you need an exotic feature the membership plan treats as a premium add-on, tally that in your comparison. The goal is not to win a rate-card beauty contest; it’s to spend less overall while running a simpler, more resilient operation.

Q: We’re a full-service restaurant. How does membership pricing affect tips and checkout speed?

Answer: The pricing model itself doesn’t change guest behavior, but the tools often do. Membership plans typically pair with modern EMV/contactless devices and tableside handhelds.

Those devices present cleaner tip prompts, reduce the “card walk” back and forth, and cut minutes off each turn—especially helpful during game nights or graduation weekends. Speed and transparency encourage tipping, and staff love not hunting receipts or waiting on an old thermal printer.

From a cost perspective, the big lever is reducing keyed entries (which can downgrade to higher interchange) and maximizing chip/tap. A good provider will also show you how to capture tip adjustments without downgrading the transaction.

Put differently, the operational upgrades that come with many membership bundles tend to improve both guest experience and cost structure—even though the “membership” label technically describes pricing.

Q: What if my business invoices for big tickets—should I push ACH to save more?

Answer: If you regularly invoice $500–$5,000 for services—contractors, clinics, creative agencies—adding ACH to your toolkit can make a noticeable dent in fees. The key is making ACH as convenient as cards: embed pay links in invoices, enable saved bank accounts through a secure vault, and offer optional instant confirmation.

Many membership providers include ACH access or price it modestly; by routing a sensible portion of high-ticket payments to ACH (with clear customer communication), you preserve card convenience for those who want points while protecting your margin on budget-sensitive clients.

Just remember that ACH has different timelines and dispute mechanics. Establish a clear policy for when work begins (e.g., after funds post or after instant-verify) and use bank-account verification tools to reduce return risk.

Put both options side by side—“Pay by Card” and “Pay from Bank”—and let customers choose; many will pick the lower-cost method when it’s frictionless.

Q: How hard is it to switch during our busy season?

Answer: Change is always easier off-peak, but you can switch safely with a parallel run. Configure the new system, run test transactions, and then process live but lower-risk payments (e.g., staff meals) side-by-side for a few days.

When you cut over, do it on a quieter morning and keep the old terminal for a day to handle refunds on pre-migration sales. A good provider will be on a live line with you during go-live and will have loaner hardware ready if something fails.

Staff training matters more than hardware specs. Give bartenders and cashiers a 10-minute cheat sheet, practice chip/tap vs. fallback steps, and role-play tips and split checks.

Most friction in a cutover comes from unfamiliar buttons, not from networks or fees. Plan for that, and the switch can be uneventful—even if your evenings are slammed.

Q: Do membership models lock me into proprietary hardware?

Answer: They shouldn’t. While some providers prefer certain devices (for speed of deployment and certification), you should be able to choose from multiple EMV/contactless terminals and POS partners.

Ask explicitly about device portability: if you ever leave, can the hardware be repurposed with another processor or gateway? Agnostic providers usually say yes and will share compatible alternatives.

Locked-down hardware can look inexpensive up front but tends to cost more over time when you need to scale or change direction.

Also ask about support for mobile and handheld devices. Pittsburgh’s sidewalk dining and event-driven traffic make it invaluable to take the checkout to the guest, which reduces walkways and keeps lines moving.

A membership plan that treats handhelds as first-class citizens will serve you better through the year’s many seasons.

Conclusion

Membership-based merchant services convert processing from a variable, often confusing expense into a predictable platform decision.

For many Pittsburgh businesses—whether you’re pouring lattes downtown, running a family-owned hardware store in the suburbs, or invoicing clients from a small office—the model can reduce costs, simplify reconciliation, and unlock better tools for omnichannel growth.

The “win” isn’t just the monthly membership math; it’s the alignment of incentives that nudges your provider to help you route transactions efficiently, keep your stack modern, and support you when it matters.

To make the model work for you, stay practical and data-driven. Use three months of real statements to compare plans. Ask for complete fee schedules and make sure the membership includes the tools you’ll actually use (gateway, invoicing, reporting, PCI help).

Plan your migration like a mini-project with a parallel run and off-peak cutover. Track the KPIs that matter—effective rate, cost per transaction, funding speed, and time saved on reconciliation—and hold your provider to those outcomes.

Pittsburgh rewards operators who balance hospitality with hard-nosed numbers. Membership pricing is one way to do exactly that: treat payments like the utility it is—reliable, transparent, and tuned to your neighborhood rhythm—so you can invest your attention where it belongs: your guests, your team, and your growth.