By Eve James July 3, 2025

Imagine a consistent flow of money coming into your company from contactless taps, in-store purchases, and online orders. Every transaction involves a careful balancing act between fees, risk, and hidden expenses. The biggest and most enigmatic participants in this dance are interchange fees. Understanding interchange as a merchant is about control, not just numbers.

Making strategic decisions regarding pricing, systems, and customer experience is made easier when you understand how these fees operate. By explaining interchange fees, their effects on your bottom line, and how to handle them, this article will provide clarity while maintaining an interactive and human-centered narrative that imagines you strolling alongside other merchants and engaging in conversation.

Why Interchange Fees Matter to You

Imagine this: You manage a small café that makes $50,000 every month from card sales. Every month, paying a 2% interchange costs $1,000. However, intelligent businesspeople don’t simply take that expense as set in stone. To learn how to manage systems, promote more intelligent payment methods, and bargain for processor markups, they approach interchange with agencies.

Because interchange-plus pricing models give you transparency by separating these base fees from the processor’s markup, they excel. In the end, being informed allows you to select the best partners and maintain healthier margins.

What Determines the Interchange Rate?

Paying 1.8% on one transaction and 2.5% on another in our coffee shop example initially appears arbitrary. Behind the scenes, however, several factors influence that rate. Card type (debit vs. credit, rewards vs. non-rewards), card brand (Visa, Mastercard, Amex), transaction method (swiped, tapped, typed), and merchant industry—classified using merchant category codes (MCC)—all influence the interchange rate.

Understanding this complex algorithm, which is designed to balance risk and reward structures, is similar to studying the detailed structure of a well-curated pricing system.

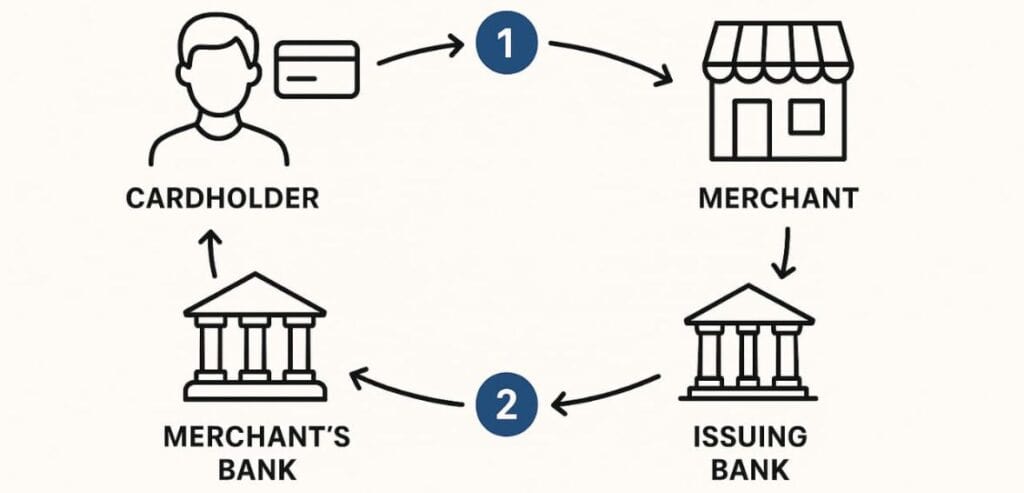

The Lifecycle of an Interchange Fee

Let’s follow a purchase: A customer purchases an espresso for $100. The issuer authorizes the payment after the acquirer submits a request to the card network. In a settlement, the issuer takes, say, $2 for interchange, passes $98 to the acquirer, and then sends the remaining amount to you, less any markups, processor margins, and network assessment fees. That $2 performs several functions, including maintaining systems—the backbone support that keeps your terminal running—building fraud defense, and funding rewards.

Global Trends and Legal Pressure

The UK tribunal recently declared that Visa and Mastercard’s interchange rates violate competition law, and Europe, on the other side of the Atlantic, caps these fees. That puts pressure on everything. In 2024, a $30 billion settlement was reached after merchants in the US successfully sued for reduced fees.

These are not merely theoretical patterns; a mere decrease of a few basis points in fees significantly improves merchant operating margins, especially for businesses operating under high-risk accounts, where interchange fees can be substantially higher.

Strategies to Reduce Interchange Costs

Networks update rates every year in April and October in response to regulatory changes, risk information, and market trends. You can proactively switch processors or renegotiate rates by keeping an eye out for these changes, particularly if you depend on important cards like rewards credit. Statements should serve as the foundation for frequent reviews. You can avoid unpleasant surprises and make sure you’re not overpaying by doing a quarterly “payment health check.”

Seeing the Bigger Picture

About 70–90% of the costs associated with accepting cards are covered by interchange forms. However, it is not an isolated entity. Additionally, there are processor markups, network assessments, PCI compliance fees, and occasionally chargeback fees. Transparency is what counts. You won’t have any control if your processor bundles everything together. However, you can intelligently challenge each component once all fees are exposed.

Staying Ahead in 2025 and Beyond

Networks update rates every year in April and October in response to regulatory changes, risk information, and market trends. You can proactively switch processors or renegotiate rates by keeping an eye out for these changes, particularly if you depend on important cards like rewards credit. Statements should serve as the foundation for frequent reviews. You can avoid unpleasant surprises and make sure you’re not overpaying by doing a quarterly “payment health check.”

Why It Feels Personal

At its core, this is about showing respect for your customers, margins, and work. It feels like giving away your pay when you pay 2% of every sale without knowing why. However, you regain agency by exploring the mechanics and observing how each swipe reroutes value into adaptable ecosystems. You’re optimizing systems to thrive, not working harder to break even.

Advanced Insights and Merchant Strategies

Stepping beyond the basics of interchange, let’s examine more complex topics that may have a big impact on your payment expenses and possibly lead to savings you weren’t aware of. Optimizing your transaction paths, comprehending unique eligibility categories, taking into account alternate payment methods, and utilizing the combined merchant strength are some of these deeper layers.

Every one of these ideas is more than just a theoretical concept; they are practical tactics that many prosperous companies employ to control their interchange footprint, and each one merits careful consideration.

Optimizing Transaction Flow and Card Presentment

Interchange rates can fluctuate by several hundred basis points due to minor adjustments in the processing of a card. Assume you manage a coffee shop and instruct your employees to always tap or swipe their cards rather than entering card information by hand.

By itself, that shifts transactions from “keyed entry” interchange rates, which are usually higher, to “card present” lower rates. Similar to this, enabling contactless NFC payments (like Apple Pay or Google Pay) allows networks to reward a lower-risk, lower-interchange category while also improving hygiene and speeding up lines.

Every contact chip transaction can be made to qualify for those lower fraud-risk categories by taking even small steps, such as making sure EMV-enabled devices are in use and are updated on a regular basis. After installing NFC-capable terminals at each table and educating employees on tap acceptance, a California restaurant reported saving an estimated $7,000 a year. That was not a result of bulk rate negotiations, but rather of a more intelligent transaction flow.

It demonstrates how doable actions can result in significant interchange reductions. Higher risk flags can also be decreased by teaching your employees to verify the cardholder’s signature requirement, recognize card logos, and refrain from force-posting transactions. Consider each swipe or tap as an opportunity to be eligible for optimal interchange rather than as a series of repetitive transactions. A little work here adds up to thousands of transactions.

Exploring Special Merchant Categories

Specialized interchange programs are beneficial for specific industries. These categories frequently benefit from lower interchange fees if you run a government agency, school, non-profit, or health-related organization. These are contractually agreed upon in the network’s regulations and are not marketing gimmicks. Finding these eligibility channels and fulfilling the exact setup requirements presents a challenge for many merchants.

For example, churches or school fundraisers can reduce their interchange from 1.8 percent to 1.1 percent—a significant difference—by registering under the appropriate MCC code. One PTA treasurer reported that during one fundraising cycle, they were able to save over $4,500 in fees by changing their carnival’s payment processor to accept the “school auxiliary” category. That will cover the cost of new playground equipment.

But compliance and honesty are crucial. You risk a fine or a subsequent audit if you use MCC codes incorrectly. It is beneficial to have a conversation with your processor, explain your processes, and ask for confirmation that the appropriate category has been used. Work with your provider to properly classify each transaction if you operate a hybrid business, such as a health-food café that offers therapeutic workshops, to prevent overpaying on high-volume categories.

Evaluating Flat-Rate vs. Interchange-Plus Models

In the past, interchange-plus pricing models—in which you pay true interchange plus a clear markup—were largely reserved for enterprise-level retailers. However, small and mid-market businesses can now access them. Clarity is a benefit; you can see interchange, evaluations, processor markup, and ask questions about each element. Because of this, optimization is feasible.

Flat-rate pricing is still useful, though, particularly for pop-ups or very small businesses that prefer consistency. It might be easier to pay 2.75% plus $0.10 per transaction if you don’t use your card frequently and don’t want any surprises. However, keep in mind that the flat-rate fee will probably surpass your cost under an interchange-plus model as your volume increases. When your monthly volume reaches six figures, you can switch to interchange-plus and save tens of thousands of dollars a year.

As they grow, many companies switch from flat-rate to interchange-plus. Knowing your transaction profile—average ticket size, transaction volume, and preferred card types—is crucial. You can use those numbers to predict which model will make the most sense over the course of the following 12 months. By upgrading at the appropriate time, you can maintain your processing costs in line with your revenue growth and achieve long-term savings.

Aggregated Buying Power Through Industry Associations

You might feel like you have little negotiating power if you run a one-person bookshop or a hair salon. However, there is actual bargaining power because there are thousands of small businesses in similar niches. For this reason, numerous industry associations, franchise groups, and local chambers bargain with payment processors for group rates.

These frequently include reduced markups, exclusive processing conditions, and even no equipment costs. Imagine a region’s five hundred separate wellness clinics working together to negotiate processing terms. No matter how small each clinic is, they can obtain interchange-plus pricing, quicker onboarding, and priority integration support by pooling volume.

These agreements resulted in average annual merchant savings of 15%, according to several state-wide chamber of commerce programs. Even though the monthly savings for each merchant might seem insignificant, they add up to a substantial amount over time.

Monitoring Compliance and Rate Changes

Regular adjustments are made to processing fees, which include interchange and network assessments, usually between April and October of each year. However, these updates appear as line items on the statement rather than on your terminal. You run the risk of overlooking a fee or increase that shouldn’t be part of your business plan if you don’t review fees on a quarterly basis.

Being proactive entails benchmarking rates following each network update window and keeping a monthly eye on your statement. Due to a misconfigured terminal, a savvy merchant in a chain of four restaurants once found a 12-cent transaction fee. Before the window closed, they had the host processor return $15,000 in inflated fees after they escalated the issue and conducted an analysis. That tale demonstrates how slippage can occur and how watchful retailers can seize significant value.

Set a “payment review” on your calendar for every three months. Verifying the correct transaction categories, confirming terminal updates, comparing current interchange rates to historical ones, and asking staff members about any anomalies they have noticed are all part of these reviews. You’re just making sure your systems stay up to date with changing fee structures, not micromanaging.

Conclusion

Although interchange fees may appear to be an intangible expense, they are influenced by real-world variables such as merchant types, network regulations, card risk, and international laws. You get clarity by approaching interchange as a puzzle rather than a burden.

You can manage these expenses by being open and honest about your pricing structures, choosing carefully which payments to accept, and being proactive with your processors. Furthermore, your voice—through trade associations or collective bargaining—matters if regulators like those in the UK are contesting interchange standards.

You’re not handling a small fee, so consider this the next time a customer taps to pay. You’re using a worldwide payment system. You are prepared to use the seams to your advantage now that you can see them.